EL BULL MARKET NO DURA PARA SIEMPRE

YA TANTO RUIDO DE ANALISTAS: HAY QUE TOMARLO EN SERIO

Por: Dennis Falvy

CONSIDER THIS A WAKEUP CALL

Last week’s volatile market is a reminder that the bull run won’t last forever.

BY MICHAEL KAHN -

Michael Kahn, a longtime columnist for Barrons.com, comments on technical analysis at www.twitter.com/mnkahn. A former Chief Technical Analyst for BridgeNews and former director for the Market Technicians Association, Kahn has written three books about technical analysis.

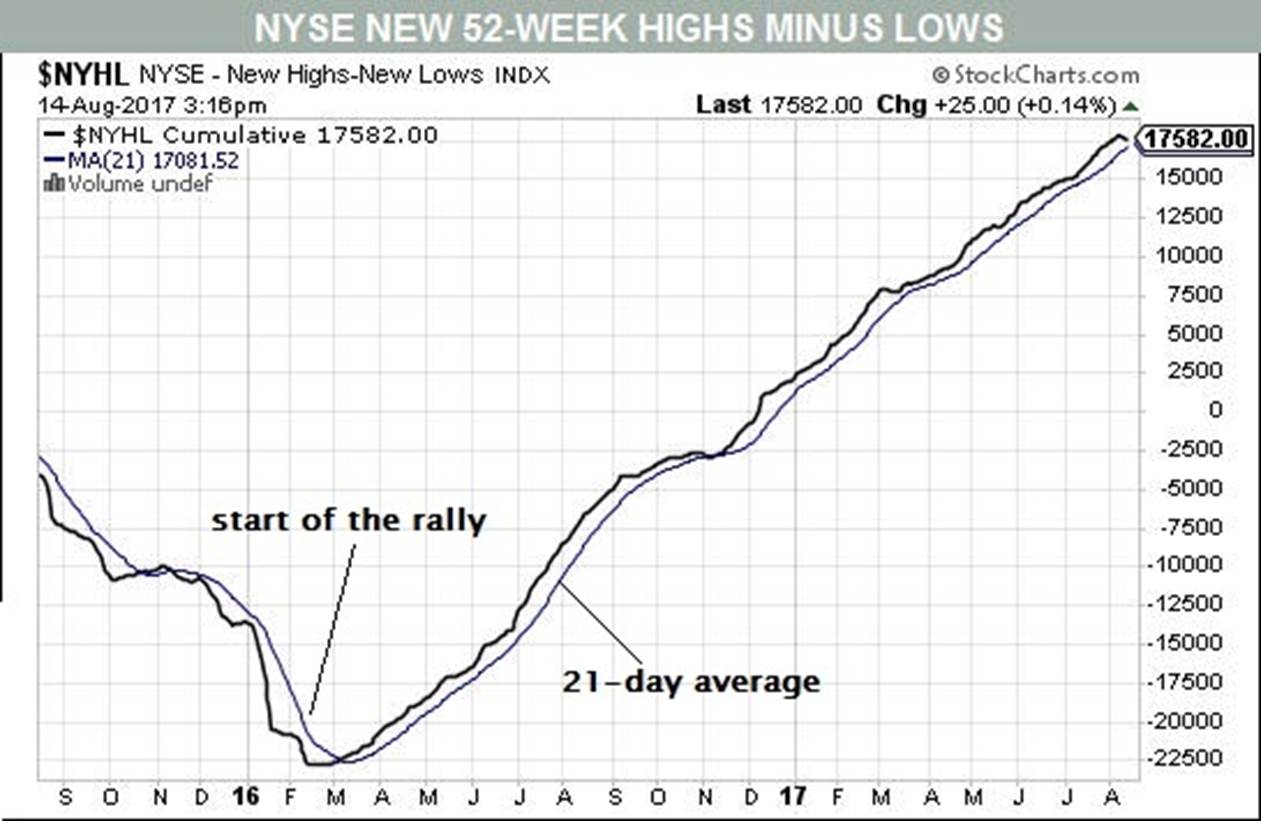

Last week, when sabers were rattling furiously over North Korea, the stock market took it as an excuse to pull back. Indeed, there were bearish reversal patterns in both the short-term and, more importantly, intermediate-term time frames, and that turned many chart watchers bearish (see Chart 1). Now, after relative calm over the weekend, stocks bounced back, keeping the bearish signals from turning into sell signals.

Chart 1

Given the lack of confirmation of the reversal and the return to more bullish breadth indications, the market remains in good shape. Of course, if the geopolitical background worsens, it will eclipse the technicals, at least temporarily.

Last week, when stocks gave back 1.4%—the Standard & Poor’s 500’s worst week since November 2016—analysts picked up on the relatively large number of new 52-week lows on both the Nasdaq and New York Stock Exchange. Considering that both indexes were just a few percent off all-time highs, this was a concern.

After all, if so many stocks were reaching new lows, it meant that the indexes were driven by only a small number of large stocks. This is called a narrow market, and it usually cannot continue climbing for long.

Even worse, the number of new lows on each index was close to 5% of all issues traded. That conjures up thoughts of the infamous Hindenburg Omen, which looks for very large percentages of new highs and new lows at the same time. The theory is that when this happens the market is unstable and prone to a big selloff.

Unfortunately for the bears, the number of new highs backed down to a very small number—which rules out a Hindenburg. Yet it still should be of concern that so many stocks are trading at such low levels when the major indexes are doing so well.

With Monday’s rebound, the number of new lows dissipated, leaving the market in a bruised condition but still in a rising trend. Both indexes are back above their 50-day moving averages, too.

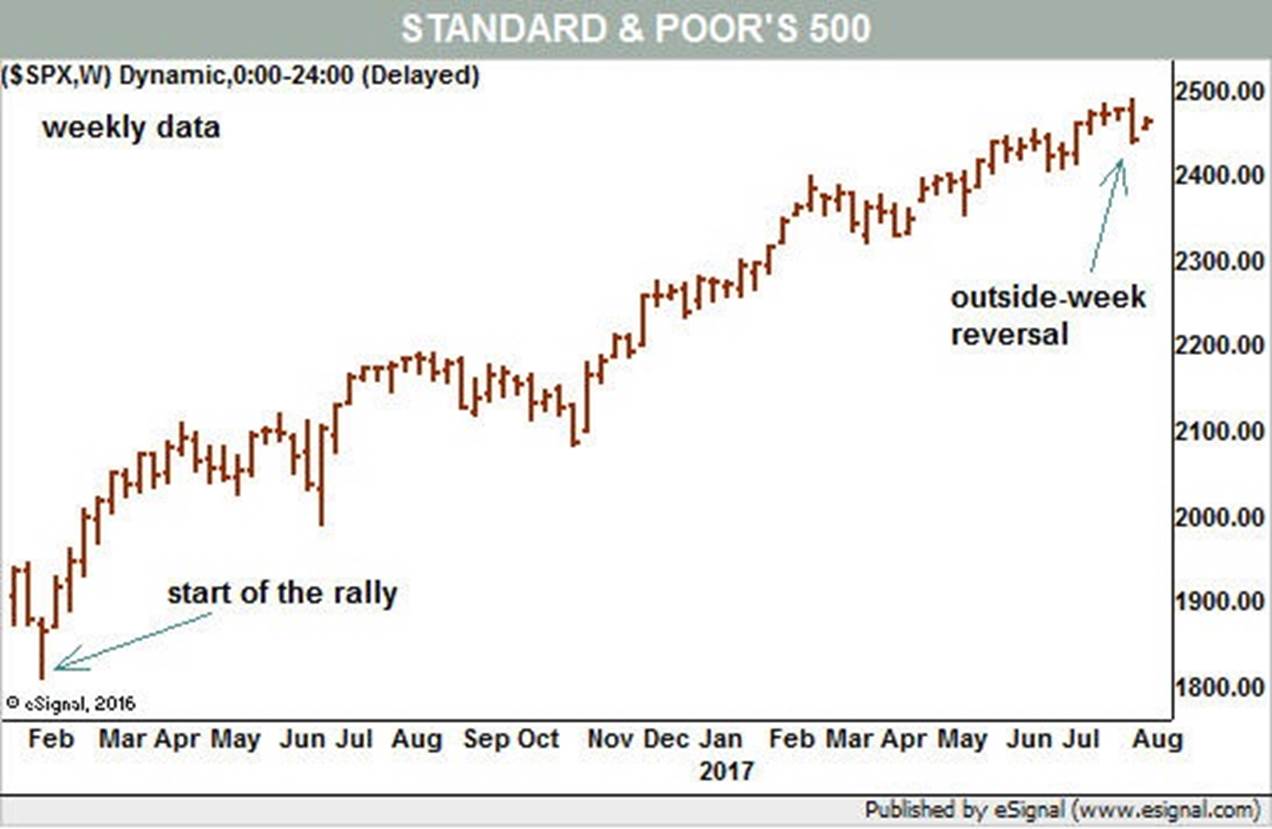

In defense of the Nasdaq and the dominance by large tech stocks within, the First Trust Nasdaq-100 Equal Weighted Index exchange-traded fund (ticker: QQEW) bounced off short-term support from its recent trading range (see Chart 2). This ETF gives all of its components an equal voice in its performance, unlike the capitalization-weighted version that is dominated by the likes of Alphabet (GOOGL) and a few others.

Chart 2

This doesn’t mean all is clear, but rather that all is not too bad. It would take a new high to break the ETF out from its range and signal that the bulls are fully back in charge.

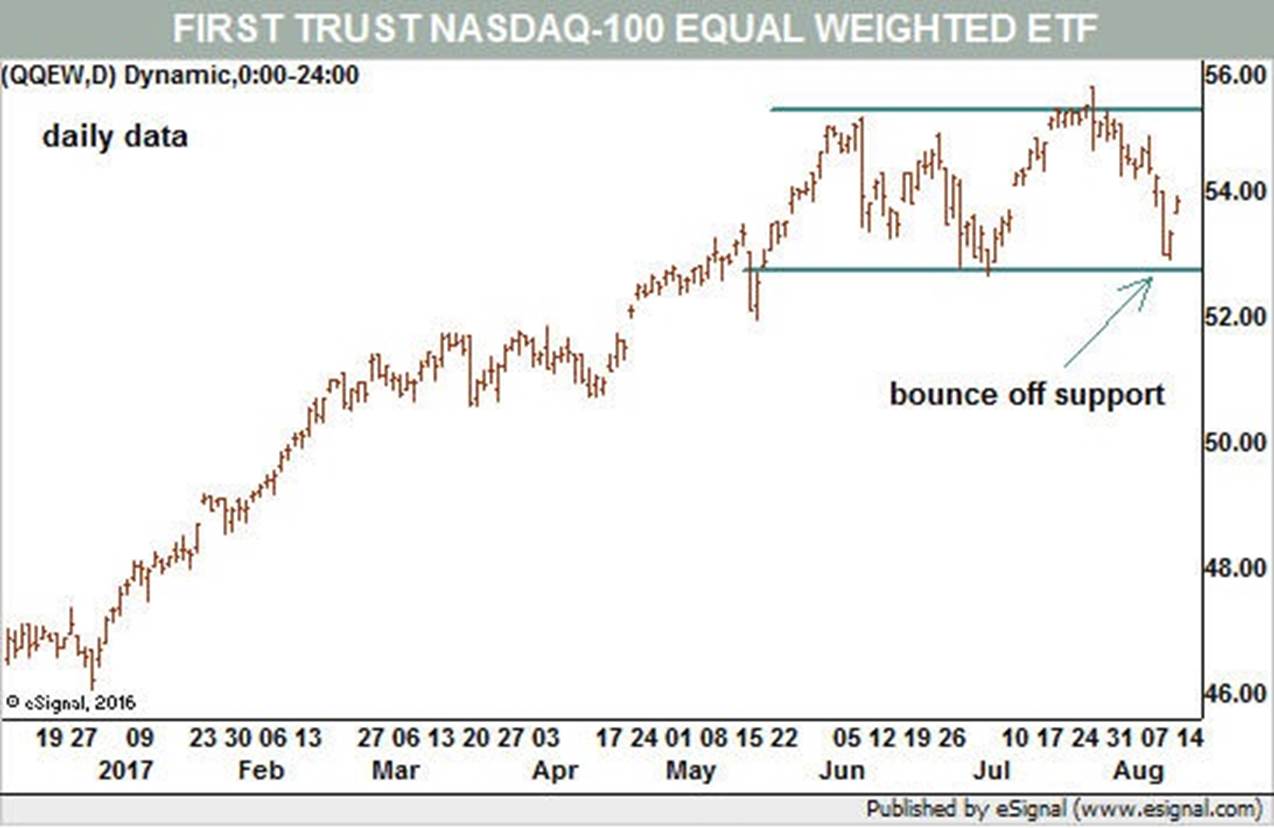

Greg Morris, a now-retired market technician who literally wrote the book on breadth indicators and who blogs at Stockcharts.com, says we need to keep the high/low data in context. Since that indicator uses a lookback period of one year, it must be used differently than indicators such as advance/decline, which looks at just single-day performance. He suggests looking at the high/low data in a cumulative format that keeps a running total of the difference of new 52-week highs minus new 52-week lows (see Chart 3).

Chart 3