EL MERCADO DEL ORO EN INGLES Y CASTELLANO

INFORME DE ORO Y FINANZAS Y EL RECIENTE DE HEBBA INVESTMENTS

Por:Dennis Falvy

(OroyFinanzas.com) – El Banco Central de China (People’s Bank of China-PBoC) no compró nuevas reservas de oro en mayo como tampoco lo hizo en marzo y abril de 2017, las últimas compras realizadas fueron de 14,07 toneladas de oro en febrero y 6,91 toneladas en enero de 2017, totalizando así sus reservas totales de oro las 1.842,6 toneladas a fecha de mayo de 2017 igualando el nivel de octubre de 2016. En noviembre de 2016 China no compró oro y vendió 20,97 toneladas en diciembre de 2016. En 2015 China compró un total de 104 toneladas de oro y en 2016 compró 60 toneladas. Según el Fondo Monetario Internacional-FMI China y Rusia están liderando la demanda de oro para sus reservas, acaparando con el 85% de las compras realizadas por los bancos centrales en los dos últimos años.

En enero 2016 China compró 16 toneladas de oro. En febrero de 2016 compró 9,5 toneladas, en marzo 9,02 y en abril 11 toneladas. En el siguiente mes, mayo, no compraron. En junio de 2016, el People’s Bank of China aumentó sus reservas de oro hasta las 58,62 millones de onzas (1.823 toneladas) desde el nivel anterior de 58,14 millones de onzas registrado anteriormente. En julio, agosto y septiembre sumó también 5 toneladas cada mes. En octubre de 2016 compró 130.000 nuevas onzas de oro (unas 4,04 toneladas), ninguna cantidad en noviembre, vendiendo en diciembre 20 toneladas.

Los chinos siguen acumulando nuevas reservas de oro pero a un ritmo más lento al que estábamos acostumbrados y algunos analistas empiezan a especular que China está intentando de nuevo no hacer públicas las compras mensuales por la situación geopolítica actual. En cambio, los rusos compraron 199 toneladas de oro en 2016 y podrían superar el volumen total de reservas de oro oficiales de los chinos en 2017 si siguen comprando al mismo ritmo creciente los próximos meses.

Suscríbase al servicio de análisis de los mercados, metales y Bitcoin de los analistas de OroyFinanzas.com con ideas de trading y análisis exclusivos para suscriptores del servicio premium de OroyFinanzas.com. Más información en este enlace.

© OroyFinanzas.com

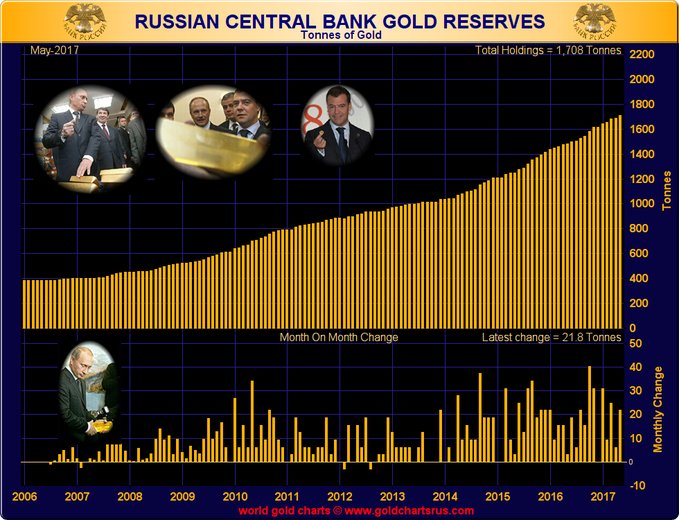

El Banco Central de Rusia compró 21,8 toneladas de oro en mayo de 2017

(OroyFinanzas.com) – En mayo de 2017, el Banco Central de Rusia compró 21,8 toneladas de oro para sus reservas oficiales. Las reservas de oro rusas han aumentado a un total de 1.708 toneladas (54,9 millones de onzas) a fecha de mayo de 2017.

COMPRAS DE ORO DEL BANCO CENTRAL DE RUSIA EN 2017

En enero de 2017, Rusia compró 1.000.000 onzas (31,104 toneladas), en febrero 300.000 onzas (9,33 toneladas), en marzo 800.000 onzas (24,822 toneladas) y 6,22 toneladas en abril de 2017.

COMPRAS DE ORO DEL BANCO CENTRAL DE RUSIA EN 2016

Entre enero y diciembre de 2016, el banco central ruso incorporó 199,062 nuevas toneladas (6,4 millones de onzas de oro) para sus reservas de oro.

En enero de 2016, Rusia compró 700.000 onzas (21,77 toneladas), en febrero 300.000 onzas (9,33 toneladas), en marzo 500.000 onzas (15,55 toneladas), en abril 500.000 onzas de oro (15,55 toneladas), en mayo 100.000 onzas (3,11 toneladas), en junio 600.000 onzas (18,66 toneladas), en julio 200.000 onzas (6,22 toneladas), en agosto 700.000 onzas (21,77 toneladas) y en septiembre 500.000 onzas (15,55 toneladas). En octubre de 2016 se realizó la compra récord de 40,44 toneladas con 1 millón de onzas. En noviembre de 2016 compraron 31,10 toneladas de oro. En diciembre de 2016, el Banco Central de Rusia no sumó nuevas compras de oro.

En 2015, el Banco Central de Rusia sumó 6.700.000 onzas troy de oro (208 toneladas) a sus reservas de oro.

Suscríbase al servicio de análisis de los mercados, metales y Bitcoin de los analistas de OroyFinanzas.com con ideas de trading y análisis exclusivos para suscriptores del servicio premium de OroyFinanzas.com. Más información en este enlace.

© OroyFinanzas.com

Salacot, un matiz, que el Banco Central de Rusia como de otros paises pueda ser autosuficiente en cuanto a recurso minero no implica siempre que no se abastezca por el medio más directo posible de metal cuando las oportunidades así se lo recomienden. Naturalmente no ocurre como en India que siempre precisa de mucho metal oro pero también se abastece de material refinado que, como casi siempre, tiene un origen, Suiza. Bastante más de la mitad del oro que llega a los bancos centrales de todo el mundo pasa por Suiza, que es sobradamente conocido como la meca de la refinación del metal oro, con una tendencia muy fuerte a seguir reforzándose, pues la confianza en el eatado de la Confederación Helvética es garantia suficiente para aquellos a quienes interesa adquirir el metal.

MERCADO DEL ORO 26 JUNIO 2017

El 10 de julio Hong Kong se lanza de nuevo a por el mercado del oro en yuanes

Hong Kong Exchanges and Clearing Limited (HKEX) va a lanzar el 10 de julio de 2017 su contrato de futuros sobre el precio del oro denominado en Renminbi Offshore (CNH) y dólares estadounidenses. Serán los primeros contratos de futuros de materias primas con entrega física en Hong Kong. Los contratos podrán negociarse a 12 meses y el primer contrato al contado para el día del lanzamiento será en el mes de agosto y los 11 meses siguientes (septiembre, octubre, noviembre, diciembre de 2017 y enero, febrero, marzo, abril, mayo, junio y julio de 2018). HKEX no cobrará comisiones de trading, compensación y liquidación los primeros seis meses de estos nuevos contratos de futuros sobre la cotización del oro.

IT IS TIME FOR PRUDENCE IN GOLD - HERE IS WHAT THAT MEANS

By: Hebba Investments .

SUMMARY

- Gold speculators closed nearly 50,000 long contracts last week, which was one of the largest speculative sell-offs of the year.

- Despite this drop in longs, gold moved very little on the week.

- Normally that would be bullish news, but weak demand in Asia and a hawkish Fed makes us very cautious.

- At this point we remain very cautious of gold's short-term picture and suggest investors remain on the sidelines.

SPECULATIVE GOLD LONGS SELL THE MOST CONTRACTS IN OVER 5 YEARS

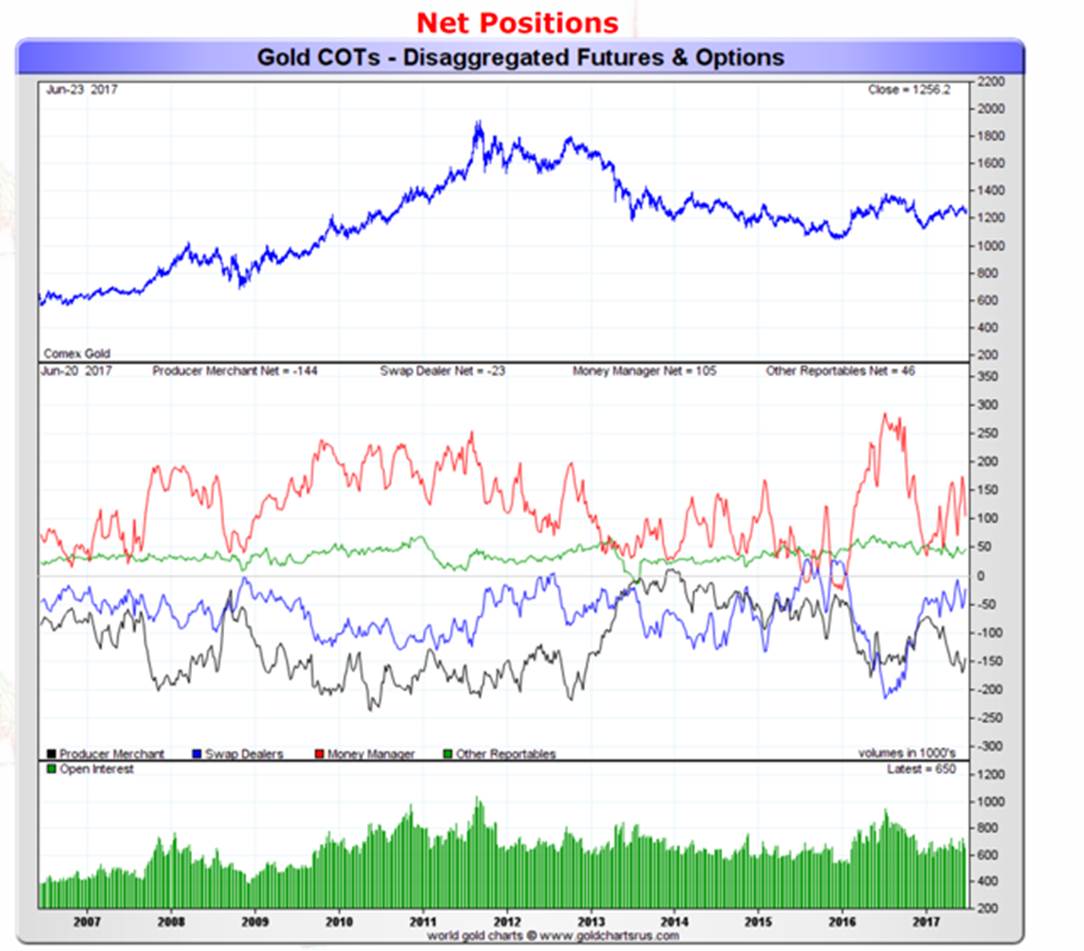

The latest Commitment of Traders (COT) report showed a week of massive speculative gold selling despite only a moderate drop in the gold price. Despite the big selling by speculative longs, we saw little action with speculative gold shorts suggesting that maybe shorts are hesitant to forecast a lower gold price or are already at comfortable positional levels.

Indian gold premiums finally rose last week after selling at a discount the previous week, while Chinese gold buying was lackluster. Finally, looking forward to next week we see little in the way of economic events, so many analysts think gold will be tracking major moves in oil and the US Dollar.

We will get more into some of these details but before that let us give investors a quick overview into the COT report for those who are not familiar with it.

ABOUT THE COT REPORT

The COT report is issued by the CFTC every Friday, to provide market participants a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. In plain English, this is a report that shows what positions major traders are taking in a number of financial and commodity markets.

Though there is never one report or tool that can give you certainty about where prices are headed in the future, the COT report does allow small investors a way to see what larger traders are doing and to possibly position their positions accordingly. For example, if there is a large managed money short interest in gold, that is often an indicator that a rally may be coming because the market is overly pessimistic and saturated with shorts - so you may want to take a long position.

The big disadvantage to the COT report is that it is issued on Friday but only contains Tuesday's data - so there is a three-day lag between the report and the actual positioning of traders. This is an eternity by short-term investing standards, and by the time the new report is issued it has already missed a large amount of trading activity.

There are many ways to read the COT report, and there are many analysts that focus specifically on this report (we are not one of them) so we won't claim to be the exports on it. What we focus on in this report is the "Managed Money" positions and total open interest as it gives us an idea of how much interest there is in the gold market and how the short-term players are positioned.

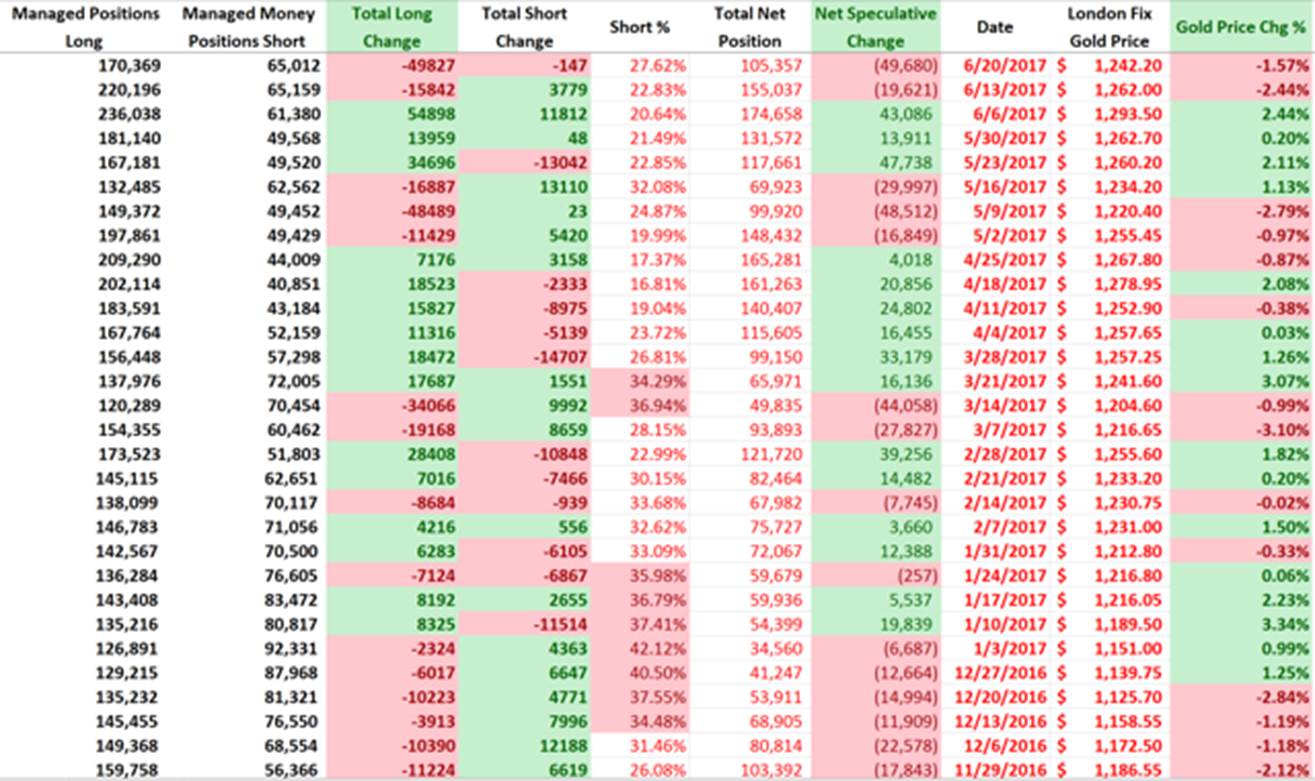

THIS WEEK'S GOLD COT REPORT

*Gold price data reflects the COT week (Tues-Tues) not a standard week (Mon-Fri)

For the second week in a row, speculative longs cut back on their long positions by a massive 49,827 contracts, which was one of the biggest speculative long drawdowns of the year. Despite this, the gold price only dropped 1.57% for the COT week and we would have expected a bit more considering the size of the long selling.

Meanwhile, speculative gold shorts closed out a tiny 147 contracts on the week, a bit unusual considering we usually see speculative shorts ADD to positions on these types of down weeks. It may suggest shorts are a bit trigger-shy or are already comfortable at their short levels and are reluctant to get "uncomfortable" and add more.

Moving on, the net position of all gold traders can be seen below:

Source: GoldChartsRUS

The red-line represents the net speculative gold positions of money managers (the biggest category of speculative trader), and as investors can see, we saw the net position of speculative traders decreased by around 50,000 contracts to 105,000 net speculative long contracts. It looks like we continue to zig-zag from average to above average levels over the past six months, with the current positions at average historical levels.

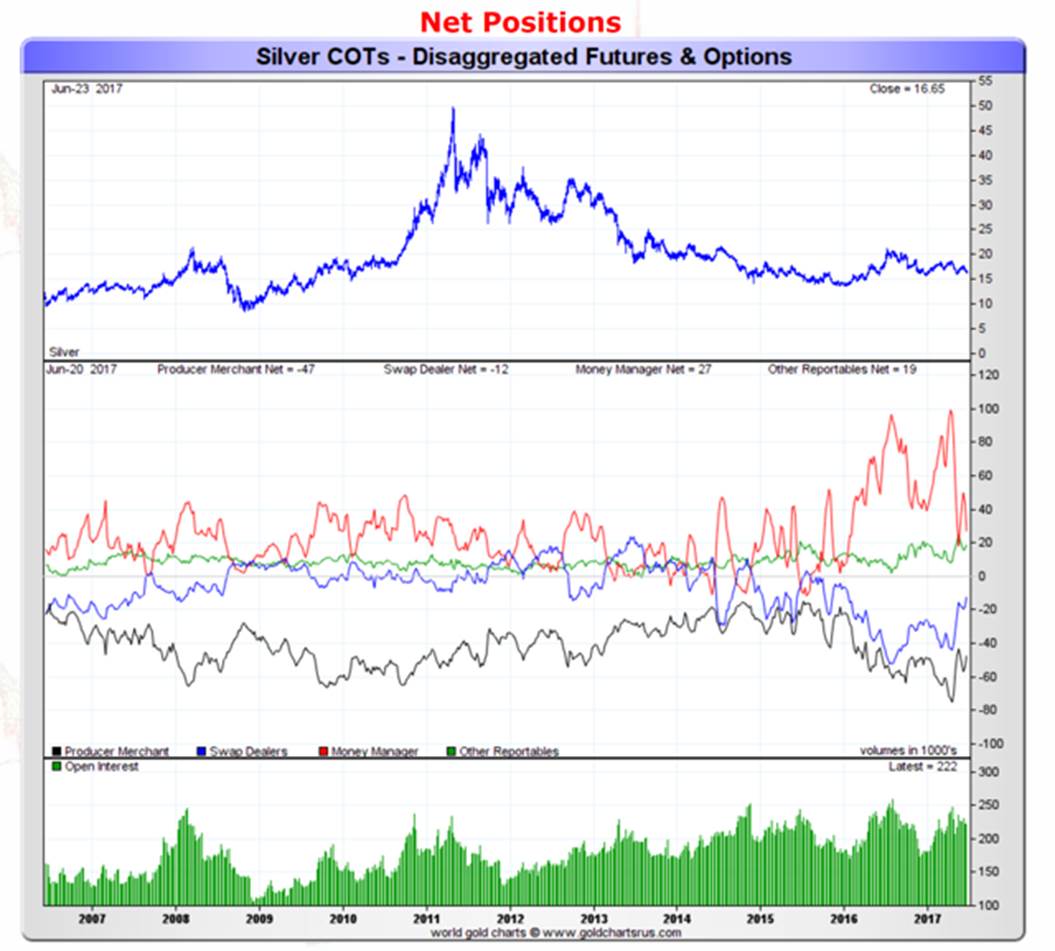

As for silver, the action week's action looked like the following:

Source: GoldChartsRUS

The red line which represents the net speculative positions of money managers, showed a decrease in the net-long silver speculator position as their total net position fell by around 17,000 contracts to a net speculative long position of 27,000 contracts.

Silver is now starting to look attractive from this perspective as we are starting to see some of the lowest net speculative levels in silver since early 2016. But we do note, which we have mentioned before, the actual fundamentals of silver remain a bit weak as physical demand has been extremely poor with silver bullion sales slow across the board.

ASIAN DEMAND

Gold traded at a premium to official domestic prices in India this week for the first time in about a month, while demand remained lackluster elsewhere in Asia despite a drop in prices.

Demand in India improved slightly, with dealers charging a premium of up to $1 an ounce over official domestic prices this week, against a discount of $3 last week. But jewelers seem to still be implementing the new goods and services tax and are reluctant to make new purchases.

In China, premiums remain unchanged as consumer sentiment remains weak despite some gold buying as prices dropped under $1250. According to Cameron Alexander, an analyst with Thomson Reuters-owned metals consultancy GFMS, "In China consumer sentiment is weak.

People are not spending money and also looking to fashion jeweler rather than investment-driven purchases."

What this means for gold investors is that caution should abound as Asian demand remains lackluster.

OUR TAKE AND WHAT THIS MEANS FOR INVESTORS

From a COT perspective, gold and silver look to be getting to healthier levels as speculators close out bullish positions. Additionally, gold total speculative short percentage of 27% is where we start to become much more interested about buying back positions - all else equal.

But we are a bit concerned about the lack of Asian demand especially considering the hawkish comments from regional Federal Reserve presidents - most notably, New York Fed President William Dudley. Gold HAS held up very well despite this backdrop, but we are very cautious and we have seen this before as gold holds up well and then proceeds to drop.

Perhaps if we see more COT speculators selling we will change our short-term view, but without any new catalysts, weak Asian demand, and hawkish comments from the Fed we have to remain short-term Neutral-Bearish on gold and silver.