ESTUPENDAS NOTAS PROVENIENTES DEL EXTERIOR

QUE HAY QUE LEERLAS CON CIERTA ACUCIOSIDAD Y TOMANDO NOTA DE ELLAS

Por:Dennis Falvy

ISN´T THAT AWKARD : THE FED MOVES ONE WAY,INFLATION ANOTHER

Inflation weakens as Fed tightens, making it harder for central bank to keep raising rates

By : Justin Lahart

One of the Fed’s aims is to get inflation up to 2%, but the Labor Department reported Wednesday that consumer prices edged lower last month. Photo: Chuck Myers/Zuma Press

Inflation is cooling again, and the Federal Reserve hopes that is only a temporary thing. What if it isn’t?

One of the Fed’s aims is to get inflation up to 2%, a rate that it believes minimizes the risks of the economy overheating or stumbling into recession. So it counted as awkward when the Federal Reserve raised rates on the same day the Labor Department reported that inflation continues to cool.

Consumer prices edged lower last month, the Labor Department reported Wednesday, driven by a decline in gasoline prices. Core prices, which exclude food and energy items to better capture inflation’s trend, came in weak for the third month running, and were up just 1.7% from a year earlier. That implies that the Fed’s preferred measure of core inflation was up just 1.4% on the year, according to J.P. Morgan ’s calculations, which would mark the slimmest gain since late 2015.

The Fed, in announcing its rate increase, indicated a bit more concern about the cool-down, specifying that it is “monitoring inflation developments closely.” Policy makers also lowered their inflation projections for this year.

But the projections also showed policy makers still expect to raise rates once more in 2017.

Additionally, they expect to start shrinking their balance sheet this year, which in effect will make monetary policy tighter.

Part of why inflation is so low is that wage growth, despite the low unemployment rate, has been weak. The Fed is working under the assumption that the tight labor market will eventually flow through into faster wage growth. But as Fed Chairwoman Janet Yellen pointed out in the press conference following the Fed’s meeting, inflation may be less sensitive to unemployment-rate declines than in the past.

There are some one-time changes in prices weighing on inflation—Ms. Yellen noted cellphone service pricing—but the weakness has occurred across enough categories that it is hard to deny that overall inflation has weakened.

Scars consumers still carry from the financial crisis may be playing a role, as might the ease with which technology allows people to ferret out bargains. Whatever the reason, just as the economy remains in a slow-growth rut, inflation might be stuck below 2%.

Investors are betting that is the case. The yield on the 10-year Treasury fell to its lowest level since November and the dollar is at its lowest level versus other major currencies since October.

If so, today’s low inflation readings shouldn’t be read as a sign that deflation risks are elevated, and that the Fed ought to counter them. But at the same time, they call into question why the Fed thinks it is a good idea to keep on raising rates. The economy is cool enough already, and the danger is that the Fed will only make it colder.

GET READY FOR THE FED’S BIG MISTAKE

By: Patrick Watson

America is fully employed, or so say the statistics. Federal Reserve officials think the job market is strong enough to justify higher interest rates. They’re afraid inflation will get out of control.

But if inflation is a problem, it’s not yet apparent in the average worker’s paycheck. “Just wait,” the inflation hawks say.

Like many economic dilemmas, this one includes several big assumptions. One is that having a job means you have a steady income. Maybe you want more, but you at least have some kind of reliable baseline.

A pile of evidence says that may no longer be a good assumption. If so, Janet Yellen and whoever follows her will be making a huge mistake. We all need to get ready for it.

Photo: AP

PERSISTENT PUZZLE

We all know people who are unemployed or underemployed – probably more than the stats say we should. Are the official numbers wrong?

Yes, they could be flawed. But even if they’re right, it doesn’t mean everyone is happy about it.

Maybe you lost your job because your company went bankrupt. No other employers in your area need your skills. You can’t sell the house and move because you’re underwater on the mortgage. With no better choices, you take a lower-skilled job at half your former pay.

Someone like that shows up as “employed full-time” in the stats. Yet they now live in a whole new world.

Such scenarios explain a lot of our discomfort. We have employment stats, we have income stats, but we lack visibility on how they interact. This makes a difference.

The New York Times had an interesting story on this point last month.

Mirella Casares has what used to be considered the keystone of economic security: a job. But even a reliable paycheck no longer delivers a reliable income.

Like Ms. Casares, who works at a Victoria’s Secret store in Ocala, Fla., more and more employees across a growing range of industries find the number of hours they work is swinging giddily from week to week — bringing chaos not only to family scheduling, but also to family finances.

And a new wave of research shows that the main culprit is not the so-called gig economy, but shifting pay within the same job.

This volatility helps unravel a persistent puzzle: why a below-average jobless rate — 4.4 percent in April — is still producing an above-average level of economic anxiety. Turbulence has replaced the traditional American narrative of steady financial progress over a lifetime.

“Since the 1970s, steady work that pays a predictable and living wage has become increasingly difficult to find,” said Jonathan Morduch, a director of the U.S. Financial Diaries project, an in-depth study of 235 low- and moderate-income households. “This shift has left many more families vulnerable to income volatility.”

Sound familiar? It should, if you work in the retailing, restaurant, or travel industry. They run 24/7 and constantly juggle staff schedules to meet shifting demand.

Among other things, this makes it very hard to cobble together a full-time income with two or more part-time jobs. The schedules inevitably conflict. You can’t be two places at once.

SWINGING PAYCHECKS

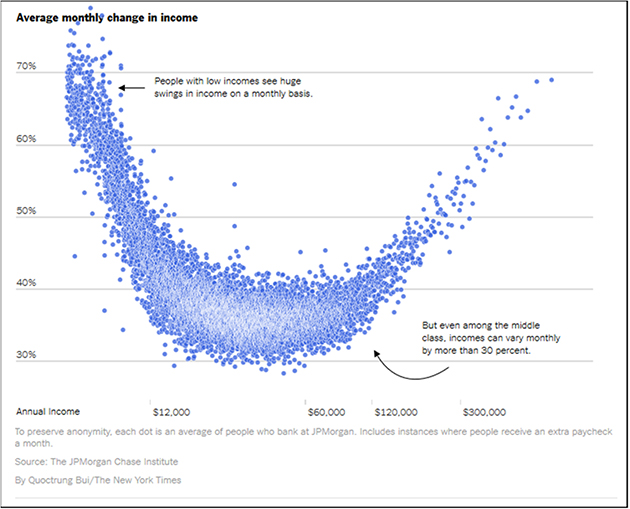

Data from the JPMorgan Chase Institute shows income swings are largest among the poor and the rich.

Image: New York Times

People on both ends of the income scale have similar variability but they don’t feel similar pain.

Wealthy people have savings and/or the ability to borrow if cash is low. For those on the lower end, an unexpected car repair or medical expense at the wrong time can be catastrophic.

Does any of this show up in the unemployment rate? No. People can be steadily “employed” but in terrible financial condition. And many are.

MAXIMUM MONETARY UNCERTAINTY

To the Fed’s Federal Open Market Committee, which meets this week, this sort of thing is not part of the mandate. The law charges them with maintaining full employment and price stability.

The problem here is that “full employment” doesn’t mean everyone is OK. It can and does coexist with widespread financial misery.

Nevertheless, Janet Yellen and the other members see the sub-5% unemployment rate as Mission Accomplished. It is their cue to stop promoting job creation and start fighting inflation.

Photo: Alex Torrenegra via Flickr

This is why the Fed is (slowly) lifting interest rates and planning to reduce its bloated bond portfolio. We might get more details tomorrow.

Predicting what the Fed will do is even harder than usual right now. The seven-member Board of Governors has three vacancies. President Trump hasn’t nominated anyone to fill them.

Moreover, Janet Yellen and Vice Chair Stanley Fischer will both likely retire in early 2018.

We could see five of seven seats change in the next year or less, and we don’t yet know who will get them. We also don’t know how quickly the Senate will confirm any new Fed governors.

Next year’s “dot plot” forecasts mean little when the key dot-makers are halfway out the door and their replacements may have entirely different ideas.

We are in a time of maximum monetary uncertainty. By this time next year, the Fed could be…

• Still on its present slow-tightening course

• Sitting on its hands and doing nothing

• Raising interest rates more aggressively

• Cutting rates lower or even going negative

All those scenarios are completely plausible. Worse, they’re equally plausible. That makes it very hard to have a matching investment strategy.

SO WHAT DO YOU DO

This is a weird environment, and it’s tempting to just sit on your hands and wait. But if you do that, you may have to wait a long time. You might miss good opportunities, too. The best answer is to be ready for anything.

See you at the top,

Wall Street's Best Minds

BILL GROSS: REAL ECONOMIC GROWTH WILL BE BELOW PAR

The fund manager writes than cheap money has created a “financial economy” that usurps the real one.

By : William H. Gross

William Hunt "Bill" Gross (born April 13, 1944) is an American investor, fund manager, and philanthropist. He co-founded Pacific Investment Management Co. Gross ran PIMCO's $270.0 billion Total Return Fund (PTTRX). Gross left Pimco to join Janus in September 2014.

Because of the secular headwinds facing global economies, currently labeled as the “New Normal” or “Secular Stagnation”, investors have resorted to “making money with money” as opposed to old-fashioned capitalism when money and profits were made with capital investment in the real economy.

How is money made with money? Think of it simply as an extension of maturity and risk – all beginning with those $20 or maybe $100 bills in your purse or stashed safely in the cookie jar at home. Since cash yields nothing, and in fact depreciates in value day to day given even low 1%-2% inflation, savers/investors exchange cash for alternative choices involving less liquid, longer maturity, and in some cases more risky assets. A bank deposit that earns interest but offers ATM accessibility in measured amounts would be a first step. The available yield – more than 0% but hardly attractive given bank fees and the like – would be a first example of making money with available cash.

But capitalism, or should I say finance-based capitalism, requires more return in order to be profitable for its savers/investors. The next step, for individuals and institutions alike, might be a 6-month CD or a 90-day Treasury bill where yields suddenly approach 1% (at least in the U.S. In Euroland and Japan they are negative but that’s another story). But 1% will not pay the bills for most savers or financial institutions where investors demand compounding returns of 6%, 7% or 8% +, so alternative assets further out the risk/liquidity/maturity spectrum come into play. Corporate bonds, stocks, and private equity are legitimate extensions from non-yielding cash that are part of modern day finance-based capitalism.

Savers/investors make money with their money (cash) as long as economies grow and inflation stays reasonably conservative. There is nothing new in all of this, but it helps to outline the fundamental process to understand why today’s economy is so different from that of decades ago and why it induces risks that were not present before.

Those differences and risks primarily are a result of secular headwinds whose effects are difficult to observe in the short run – much like global warming. “New Normal” high debt, aging demographics, and deglobalization along with technological displacement of labor are the primary culprits.

Excessive debt/aging populations/trade-restrictive government policies and the increasing use of machines (robots) instead of people, create a counterforce to creative capitalism in the real economy, which worked quite well until the beginning of the 21st century. Investors in the real economy (not only large corporations but small businesses and startups) sense future headwinds that will thwart historic consumer demand and they therefore slow down investment. Productivity – which is the main driver of economic growth and long-term profits – slows down. Productivity in fact, in the U.S. and almost everywhere in the developed world has flat-lined for nearly five years now and has increased by only 1% annually since 2000 and the aftermath of the Dot-Com recession.

So instead of making money by investing in the real economy, savers/investors increasingly are steered toward making money in the financial economy – making money with money. And that, thanks to nearly $8 trillion of QE asset purchases from major central banks and the holding of short-term borrowing rates near zero or even negative, has made this secular shift in monetary policy extremely profitable. Bank margins have been lowered but their stocks and almost all other stocks have soared here in the U.S. and globally.

Investors have discovered that making money with money is a profitable enterprise and have exchanged the support of central banks for the old-time religion of productivity growth as a driver of their strategy. The real economy has been usurped by the financial economy. Long live the financed-based economy!

But asset prices and their growth rates are ultimately dependent on the real economy and, the real economy’s growth rate is stunted by secular forces which monetary and even future fiscal policies seem unable to reverse. In fact, as I have mentioned many times in prior Investment Outlooks, monetary policy may now be a negative influence in terms of future economic growth. Zombie corporations are being kept alive as opposed to destroyed as with the Schumpeterian/Darwinian “survival of the fittest” capitalism of the 20th century. Standard business models forming capitalism’s foundation, such as insurance companies, pension funds, and banking, are threatened by the low yields that have in turn, produced high asset prices. These sectors in fact, have long-term maturities and durations of their liabilities, and their assets have not risen enough to cover prior guarantees, so we see Puerto Rico, Detroit, and perhaps Illinois in future years defaulting in one way or the other on their promises to constituents. Faulty finance-based capitalism supported by the increasingly destructive monetary policy begins to erode, not support the real economy.

My point in all of this is that making money with money is an inherently acceptable ingredient in historical capitalistic models, but ultimately it must then be channeled into the real economy to keep the cycle going.

Capitalism’s arteries are now clogged or even blocked by secular forces which when combined with low/negative yielding “safe” assets promise to stunt U.S. and global growth far below historical norms.

Ultimately investors must recognize this risk along with increasingly poorly hedged liabilities and low growth resulting from “New Normal” secular headwinds in developed economies. Add global warming to this list, and you have the potential for low asset returns in which the now successful strategy of “making money with money” is seriously threatened. How soon this takes place is of course the investor’s dilemma, and the policymakers’ conundrum. But don’t be mesmerized by the blue skies created by central bank QE and near perpetually low interest rates.

ALL MARKETS ARE INCREASINGLY AT RISK.

Money will currently be made, or at least conservatively preserved, by acknowledging the exhaustion of “making money with money”.

Strategies involving risk reduction should ultimately outperform “faux” surefire winners generated by central bank printing of money. It’s the real economy that counts and global real economic growth is and should continue to be below par.

Gross manages the Janus Henderson Global Unconstrained Bond fund (JUCTX).

THE MADNESS OF KING DONALD

When people start asking questions about a king's mental stability, the story usually doesn't end well for the monarch.

By : Richard Evans ; Illustration by Bruce Emmett

Richard Evans is a British historian of 20th-century Europe with a focus on Germany and World War II. His latest book is, “The Pursuit of Power: Europe 1815-1914." (@richardevans36)

Donald J. Trump, the 45th president of the United States, has not been in office for very long, but already the contours and characteristics of his rule have become clear. Rather than govern conventionally, through officers of state appointed for their competence and experience and with the agreement, however reluctant, of Congress, he has chosen to gather round him an informal coterie of friends, advisors, and relatives — many of them, like himself, without any experience of government at all — while railing against the restrictions imposed on him by constitutional arrangements such as the independence of the press and the judiciary.

Trump’s entourage resembles nothing more closely than the court of a hereditary monarch, with informal structures of rule elbowing aside more formal ones. Trump did, after all, win widespread support in the electorate by promising precisely this: shaking up, bypassing or overthrowing the Washington establishment and trying something new.

The result, however, has been chaos and confusion, contradiction and paralysis. It has become clear that the president of the United States is someone who does not read his briefs; who does not take the advice of experts in the intelligence field or indeed in any other; who fires off brief statements without thinking whether they are consistent with his administration’s declared policies; who is seemingly incapable of putting together a coherent sentence with a subject, a verb, and an object; who is apt to give away state secrets to a foreign power; and who seems to have no respect either for the truth or for the Constitution (not least in respect of freedom of religion and freedom of speech).

He may not be mad, but a growing number of commentators allege that Trump is suffering from dementia, or is mentally subnormal, or is suffering from a personality disorder of some kind.

In a situation where a head of state is incapable of carrying out his duties properly, what guidance can history offer us? The relevant history isn’t so much the history of the presidency of the United States, where no incumbent has ever been successfully removed from office by Congress, but rather the history of incompetent — or allegedly incompetent — rulers at other times and in other parts of the world.

What happens when a political elite concludes that the real or titular head of state has to be deposed in the interests of the country as a whole? Of course, given Trump’s leadership style, the pertinent question might be narrowed down further: What happens when a monarch is judged as mentally unfit to rule?

An 1840 portrait of Ferdinand I of Austria by Francesco Hayez.

In modern times, just as further back in history, madness is a slippery concept, hard to pin down unless there are obvious signs of delusion, derangement, paranoia, or actual physical aggression.

But madness of that sort was far from uncommon in Europe’s royal families, not least because of the inbreeding favored by their convention that members of a royal family could not marry beneath their station. As Erik Midelfort explains in his entertaining 1996 monograph Mad Princes of Renaissance Germany, in 16th-century Germany nearly 30 dukes, landgraves, and counts were regarded by their courts and ministers as mad enough to require medical attention or removal from office. But what exactly was meant by “mad”? Midelfort explains that advisors and family members spoke of “weakness, folly, debility, and the condition of not being right,” or sometimes “furor, or melancholy, or sickness” when they encountered princes who seemed to be mentally unsuited to rule. The notion of clinical insanity or certifiable madness is one that only became current in the 19th century.

In the early modern period, a few princes were clearly completely deranged, like Don Julius Caesar d’Austria, son of Holy Roman Emperor Rudolf II, who tortured his mistress to death and walked about for days covered in her blood and brains, attacked his servants, destroyed his furniture, tore up his clothing, babbled and roared nonsensically, and was (allegedly) eventually strangled on his father’s orders in 1609. Some suffered from delusions, like Duke Albrecht Friedrich of Prussia, who slept in his clothes in case the Turks came for him in the night, poured his medicines on the floor, spoke to people who were not present in the room, and threw a clock at an envoy sent by Emperor Maximilian II. Relatives were appointed to carry out the business of ruling, bypassing the unfortunate duke, who was left to amuse himself with his collection of 100,000 coins while being subjected to a variety of grotesque “cures” applied by rival schools of medicine.

More common, however, was “melancholy,” or, as we would put it today, depression, sometimes attributed in the medieval or early period to demonic influences. And debilitation from such melancholy — or through paralysis or speech impediments caused by strokes, senility, dementia, and other afflictions of old age — were typically dealt with by finding someone else to rule without actually deposing the prince.

But not always. Consider the example of the 1848 revolutions in Central Europe. The fact that the Austrian Empire’s ruler, Ferdinand I, was barely capable of carrying out his duties had been known from the moment he came to the throne, following the normal line of hereditary succession in the House of Habsburg. Stories of his limited intellectual capacity were legion. When he was told one day that he could not have apricot dumplings because they were out of season, he lost his temper. “I’m the emperor,” he shouted at his cook, “and I want dumplings!”

The offspring of double first cousins — his parents, in other words, shared all four grandparents — he was slow to learn to read and write, subject to epileptic fits, had a speech impediment, and was clearly incapable of carrying out his imperial duties. When he came to the throne in 1835, the country’s leading statesman, Prince Klemens von Metternich, ensured that the business of the emperor was carried out by a council consisting of himself, another politician, and the emperor’s uncle, Archduke Louis.

But this situation could not stave off the revolution that came in 1848. As the crowds marched toward the imperial palace in Vienna, Ferdinand summoned Metternich and asked “what are all those people doing there, then?” “They are making a revolution,” Metternich replied. “What, are they allowed to do that?” Ferdinand asked in astonishment. Not surprisingly, as the revolution took a grip, he was persuaded by his family to abdicate in favor of his 18-year-old nephew, who became Franz Joseph I. (The Habsburgs were always optimists, but there never was a Ferdinand II or a Franz Joseph II.) As Franz Joseph was defeated by Otto von Bismarck’s Prussian armies in the war of 1866, Ferdinand had the last laugh. “I don’t know why they appointed Franz Joseph,” he is said to have remarked: “I could have been just as good at losing battles.”

An 1816 portrait of King George IV by Thomas Lawrence,

The Habsburg Empire in the mid-19th century was in a desperate situation requiring desperate remedies, which is why the hapless Ferdinand accepted his deposition, if with great reluctance. In the case of monarchical incapacity, deposition was seldom resorted to because a general belief in the divine right of kings got in the way. If God had put the monarch on the throne — and the belief was a central part of monarchical legitimacy — then only God could remove him; mere humans had no right to. So, in more normal times, when the political structure as a whole was not under threat, abdication was typically avoided.

It was usual instead to appoint a regent to take care of royal business when the monarch became incapacitated, as for example during the few weeks in 1878 when the German Kaiser Wilhelm I was recovering from a nearly successful assassination attempt. Regents assumed all the powers of the monarch, just not the title of King

The most famous appointment of a regent was to King George III, after he began talking to trees and speaking continuously to nobody in particular for hours on end in the early 19th century. In a rare moment of lucidity, he agreed he was no longer capable of ruling, and in 1811 conceded the appointment by act of Parliament of his eldest son George as prince regent. The prince regent, who later became King George IV on his father’s death, was not exactly a model monarch either: Addicted to opium, a heavy drinker, and a gluttonous eater, he weighed 245 pounds and had a 50-inch waistline. His extravagance and drunkenness made him unpopular, and his brother William IV, who succeeded him in 1830 at the age of 64, the oldest person to come to the throne so far, was accustomed to wander the streets off on his own, going up to ordinary citizens to speak to them (“I’m the king, you know”). The courtier and diarist Charles Greville declared that William IV “made a number of speeches, so ridiculous and nonsensical, beyond all belief but to those who heard them, rambling from one subject to another, repeating the same thing over and over again, and altogether such a mass of confusion, trash, and imbecility as made one laugh and blush at the same time.” Greville thought the king was mad, and indeed the monarch was known as “Silly Billy” by the populace at large.

But the British monarchy of the early 19th century, for all the weaknesses of its incumbents, survived because by this stage of history the kings and queens of England had very little real power. Over time, leading politicians became less hesitant to transgress alleged monarchial power that was no longer extant. It was not long before the idea of a regency fell entirely out of favor in Britain and elsewhere in Europe. When a British monarch transgressed the largely unwritten rules of the job, as King Edward VIII did in 1936 by declaring his intention of marrying an American divorcée, Wallis Simpson, the politicians had little difficulty in simply removing him from the throne. Europe’s last enactment of a regency was in the case of King Otto of Bavaria, younger brother of the eccentric Ludwig II, builder of the fairy castles of Neuschwanstein and Hohenschwangau. On Ludwig’s unexplained and sudden death, Otto succeeded to the throne, but succumbed rapidly to a deep and incurable depression, probably caused by syphilis (he was paralyzed during the final period of his life). A prince regent, Otto’s uncle Luitpold, took over for Otto, ruling from 1886 to 1912, followed by a cousin, Ludwig, who quickly got the Bavarian parliament to depose Otto and declare himself king.

In a situation such as this, the royal family’s role was at least as important as that of the political elite. Both had a strong interest in ensuring the business of government was carried on in the usual way, just not by the existing monarch. The most favored way of removing from office a monarch who has shown himself to be unfit to rule has indeed in modern times been abdication at the behest of leading politicians, usually with the support of the royal family.

After the Ottoman Sultan Abdulaziz was deposed by his ministers because of incompetence, his chosen successor, his nephew Murad V, threw himself into a pool in the palace gardens, shouting to the guards to save him from assassination, and was reported to have vomited continuously for a day and a night in sheer terror. He had reason to be frightened: Within a few days it was implausibly reported that Abdulaziz had committed suicide by cutting both his wrists simultaneously with a pair of scissors. Within a few months, Murad was deposed by a coalition of family members and government ministers amid allegations of paranoia and schizophrenia, and imprisoned for the rest of his life. (Two assassinations of Ottoman sultans in a single year would have aroused too many public suspicions.) The young man was probably glad to be relieved of the burdens and cares of royal office.

Emperor Bokassa, of the now Central African Republic, stands on the throne in December 1977 after crowning himself ruler. (Photo credit: PIERRE GUILLAUD/AFP/Getty Images)

What would happen if a monarch does not cooperate with political elites who consider him deranged? In that case, removal by force becomes an option, though sometimes it can only be effected through the intervention of a foreign power. This is what occurred to the self-styled Emperor Bokassa of what is now the Central African Republic in 1979. Bokassa had himself come to power in a military coup, and almost immediately dissolved the national assembly and banned all political parties except his own. Until that point, his career was similar to that of any other tin-pot dictator.

But he soon began to show signs of megalomania. In 1976, he had himself crowned emperor, in a lavish ceremony that cost a third of his impoverished country’s annual budget. His extravagant pseudo-Napoleonic display and absurd, self-awarded titles earned him the mockery of the rest of the world, but there was a darker side to his rule: He arrested, tortured and personally murdered many of his opponents. He killed a number of schoolchildren who had thrown rocks at his car in protest against their families being forced to buy expensive school uniforms with a picture of his head on them from a firm owned by one of his many wives.

What may have done him in were the lurid allegations that he had eaten the bodies of some of his victims — or, more specifically, that he had them cooked and served up to the visiting president of France, Valéry Giscard d’Estaing. Afterward, in 1986, he was deposed and arrested by a military expedition sent by France to restore order in its former colony, and then put on trial in the Central African Republic. Found guilty on charges of murder and many other offenses (though not including cannibalism), he was sentenced to life imprisonment but subsequently released on amnesty in 1993. Meanwhile, his mental state deteriorated still further until within a few years he was claiming to be the 13th apostle of Christ.

Emperor Bokassa’s power was not only real, it was absolute, and in general it is a fairly obvious point that the more actual political power a monarch possesses, the more difficult he is to remove through legal means, and the more likely it is, therefore, that he will be coerced into abdicating, whether by his own subjects, or by outsiders.

If we look back beyond the 19th and 20th centuries to more remote periods of history, we encounter many such examples. One of very few monarchs to have earned madness as a title, the 16th-century Spanish Queen Juana la Loca, was dealt with by being forcibly confined to a nunnery. An earlier insane monarch, Charles the Mad of France, was not actually deposed, but after he murdered several of his entourage without warning in 1392 he was pushed aside by his wife and his closest male relatives and completely excluded from power. This was just as well, since his madness grew more pronounced and manifested itself in disagreeable episodes such as his refusal to wash or change his clothes for several months in 1405.