HAY UNA EXTENSA VARIEDAD DE ANALISIS

EN ESTA SELECCION DE ARTICULOS DEL EXTERIOR

Por: Dennis Falvy

FOUNDATION - THE FALL OF THE AMERICAN GALACTIC EMPIRE

BY: THE BURNING PLATFORM

"The fall of Empire, gentlemen, is a massive thing, however, and not easily fought. It is dictated by a rising bureaucracy, a receding initiative, a freezing of caste, a damming of curiosity—a hundred other factors. It has been going on, as I have said, for centuries, and it is too majestic and massive a movement to stop."

"Any fool can tell a crisis when it arrives. The real service to the state is to detect it in embryo."

- Isaac Asimov, Foundation

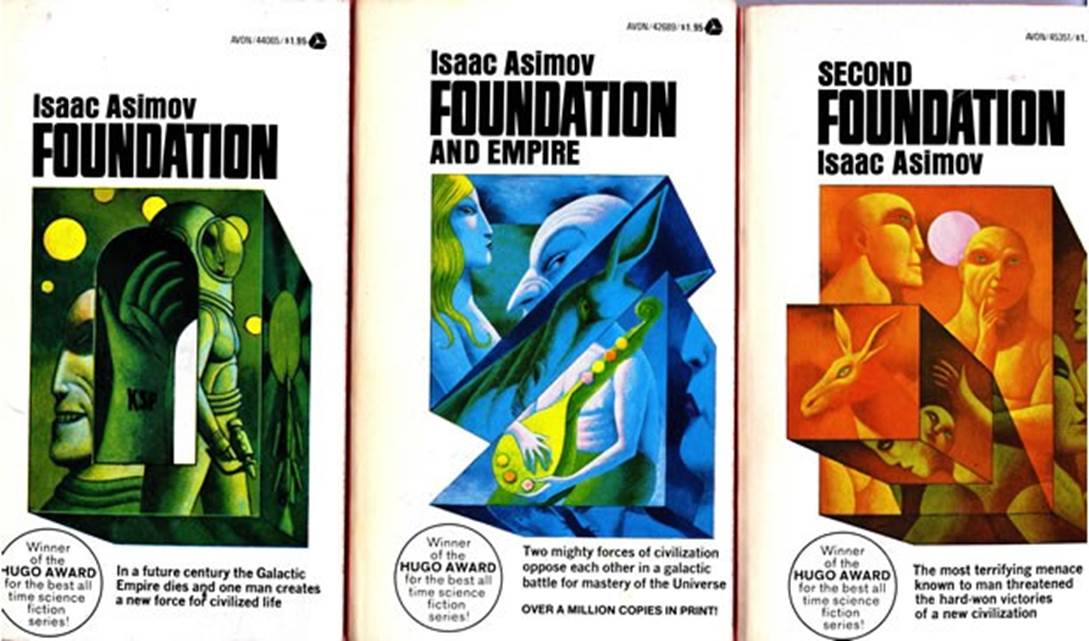

I read Isaac Asimov's renowned award winning science fiction trilogy four decades ago as a teenager.

I read them because I liked science fiction novels, not because I was trying to understand the correlation to the fall of the Roman Empire. The books that came to be called the Foundation Trilogy (Foundation, Foundation and Empire, and Second Foundation) were not written as novels; they're the collected Foundation stories Asimov wrote between 1941 and 1950. He wrote these stories during the final stages of our last Fourth Turning Crisis and the beginning stages of the next High. This was the same time frame in which Tolkien wrote the Lord of the Rings Trilogy and Orwell wrote 1984. This was not a coincidence.

The tone of foreboding, danger, dread, and impending doom, along with unending warfare, propels all of these novels because they were all written during the bloodiest and most perilous portion of the last Fourth Turning. As the linear thinking establishment continues to be blindsided by the continued deterioration of the economic, political, social, and cultural conditions in the world, we have entered the most treacherous phase of our present Fourth Turning.

That ominous mood engulfing the world is not a new dynamic, but a cyclical event arriving every 80 or so years. Eight decades ago the world was on the verge of a world war which would kill 65 million people. Eight decades prior to 1937 the country was on the verge of a Civil War which would kill almost 5% of the male population. Eight decades prior to 1857 the American Revolution had just begun and would last six more bloody years. None of this is a coincidence.

The generational configuration repeats itself every eighty years, driving the mood change which leads to revolutionary change and the destruction of the existing social order.

Isaac Asimov certainly didn't foresee his Foundation stories representing the decline of an American Empire that didn't yet exist. The work that inspired Asimov was Edward Gibbon's multi-volume series, The Decline and Fall of the Roman Empire, published between 1776 and 1789. Gibbon saw Rome's fall not as a consequence of specific, dramatic events, but as the result of the gradual decline of civic virtue, monetary debasement and rise of Christianity, which made the Romans less vested in worldly affairs.

Gibbon's tome reflects the same generational theory espoused by Strauss and Howe in The Fourth Turning. Gibbon's conclusion was human nature never changes, and mankind's penchant for division, amplified by environmental and cultural differences, is what governs the cyclical nature of history.

Gibbon constructs a narrative spanning centuries as events unfold and emperors' successes and failures occur within the context of a relentless decline of empire. The specific events and behaviors of individual emperors were inconsequential within the larger framework and pattern of historical decline. History plods relentlessly onward, driven by the law of large numbers.

ASIMOV DESCRIBED HIS INSPIRATION FOR THE NOVELS:

"I wanted to consider essentially the science of psychohistory, something I made up myself. It was, in a sense, the struggle between free will and determinism. On the other hand, I wanted to do a story on the analogy of The Decline and Fall of the Roman Empire, but on the much larger scale of the galaxy. To do that, I took over the aura of the Roman Empire and wrote it very large. The social system, then, is very much like the Roman imperial system, but that was just my skeleton.

It seemed to me that if we did have a galactic empire, there would be so many human beings”quintillions of them”that perhaps you might be able to predict very accurately how societies would behave, even though you couldn't predict how individuals composing those societies would behave. So, against the background of the Roman Empire written large, I invented the science of psychohistory. Throughout the entire trilogy, then, there are the opposing forces of individual desire and that dead hand of social inevitability."

IS HISTORY PRE-DETERMINED?

"Don't you see? It's Galaxy-wide. It's a worship of the past. It's a deterioration - a stagnation!"

- Isaac Asimov, Foundation

"It has been my philosophy of life that difficulties vanish when faced boldly."

- Isaac Asimov, Foundation

The Foundation trilogy opens on Trantor, the capital of the 12,000-year-old Galactic Empire.

Though the empire appears stable and powerful, it is slowly decaying in ways that parallel the decline of the Western Roman Empire. Hari Seldon, a mathematician and psychologist, has developed psychohistory, a new field of science that equates all possibilities in large societies to mathematics, allowing for the prediction of future events.

Psychohistory is a blend of crowd psychology and high-level math. An able psychohistorian can predict the long-term aggregate behavior of billions of people many years in the future.

However, it only works with large groups. Psychohistory is almost useless for predicting the behavior of an individual. Also, it's no good if the group being analyzed is aware it's being analyzed — because if it's aware, the group changes its behavior.

Using psychohistory, Seldon has discovered the declining nature of the Empire, angering the aristocratic rulers of the Empire. The rulers consider Seldon's views and statements treasonous, and he is arrested. Seldon is tried by the state and defends his beliefs, explaining his theory the Empire will collapse in 300 years and enter a 30,000-year dark age.

He informs the rulers an alternative to this future is attainable, and explains to them generating an anthology of all human knowledge, the Encyclopedia Galactica, would not avert the inevitable fall of the Empire but would reduce the Dark Age to "only" 1,000 years.

The fearful state apparatchiks offer him exile to a remote world, Terminus, with other academic intellectuals who could help him create the Encyclopedia. He accepts their offer, and sets in motion his plan to set up two Foundations, one at either end of the galaxy, to preserve the accumulated knowledge of humanity and thereby shorten the Dark Age, once the Empire collapses. Seldon created the Foundation, knowing it would eventually be seen as a threat to rulers of the Empire, provoking an eventual attack. That is why he created a Second Foundation, unknown to the ruling class.

Asimov's psychohistory concept, based on the predictability of human actions in large numbers, has similarities to Strauss & Howe's generational theory. His theory didn't pretend to predict the actions of individuals, but formulated definite laws developed by mathematical analysis to predict the mass action of human groups. His novel explores the centuries old debate of whether human history proceeds in a predictable fashion, with individuals incapable of changing its course, or whether individuals can alter its progression.

The cyclical nature of history, driven by generational cohorts numbering tens of millions, has been documented over centuries by Strauss & Howe in their 1997 opus The Fourth Turning.

Human beings in large numbers react in a herd-like predictable manner. I know that is disappointing to all the linear thinking individualists who erroneously believe one person can change the world and course of history.

The cyclical crisis's that occur every eighty years matches up with how every Foundation story centers on what is called a Seldon crisis, the conjunction of seemingly insoluble external and internal difficulties. The crises were all predicted by Seldon, who appears near the end of each story as a hologram to confirm the Foundation has traversed the latest one correctly.

The "Seldon Crises" take on two forms. Either events unfold in such a way there is only one clear path to take, or the forces of history conspire to determine the outcome. But, the common feature is free will doesn't matter. The heroes and adversaries believe their choices will make a difference when, in fact, the future is already written. This is a controversial viewpoint which angers many people because they feel it robs them of their individuality.

Most people don't want to be lumped together in an amalgamation of other humans because they believe admitting so would strip them of their sense of free will. Their delicate sensibilities are bruised by the unequivocal fact their individual actions are virtually meaningless to the direction of history. But, the madness of crowds can dramatically impact antiquity.

"In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first."

- CHARLES MACKAY, EXTRAORDINARY POPULAR DELUSIONS AND THE MADNESS OF CROWDS

Many people argue the dynamic advancements in technology and science have changed the world in such a way to alter human nature in a positive way, thereby resulting in humans acting in a more rational manner. This alteration would result in a level of human progress not experienced previously. The falsity of this technological theory is borne out by the continuation of war, government corruption, greed, belief in economic fallacies, civic decay, cultural degradation, and global disorder sweeping across the world. Humanity is incapable of change.

The same weaknesses and self- destructive traits which have plagued them throughout history are as prevalent today as they ever were.

Asimov's solution to the failure of humanity to change was to create an academic oriented benevolent ruling class who could save the human race from destroying itself. He seems to have been well before his time with regards to creating Shadow Governments and Deep State functionaries. It appears he agreed with his contemporary Edward Bernays. The masses could not be trusted to make good decisions, so they needed more intellectually advanced men to guide their actions

"The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of. This is a logical result of the way in which our democratic society is organized.

Vast numbers of human beings must cooperate in this manner if they are to live together as a smoothly functioning society. …In almost every act of our daily lives, whether in the sphere of politics or business, in our social conduct or our ethical thinking, we are dominated by the relatively small number of persons…who understand the mental processes and social patterns of the masses. It is they who pull the wires which control the public mind."

___________________________________________________________________________ CATALYST FOR CHAOS

BY: MICHAEL PENTO

Up until very recently, stocks had been humming along without so much as a minor speedbump and volatility was becoming a distant memory.

However, it now seems prudent to once again remind investors that this extremely overvalued market is headed for an epic crash. The Cassandras, myself included, have been wrong about this warning for what seems like a long time. Nevertheless, much like those who warned of a housing bubble a few years before the bottom completely fell out, reality is destined to slam into the current triumvirate of asset bubbles, and those sounding the alarm will be proven correct again.

The governments' massive interest rate manipulation and record amount of new debt accumulation have engendered unprecedented equity, real estate and fixed income bubbles across the globe.

But what could finally be the catalyst that sets off the inevitable deleveraging and reconciliation of asset prices into motion?

A very good candidate for this is the eventual tapering of the Quantitative Easing (QE) programs currently underway courtesy of the European Central Bank (ECB) and Bank of Japan (BOJ). There is a very good chance that upon the announcement of a commitment to end the QE programs in either of these countries will lead to a sudden and chaotic surge in borrowing costs worldwide.

Of course, Wall Street cheerleaders will scoff at this notion; claiming that the Fed was able to begin winding down QE in December of 2013 and was done by October 2014, with nary a hiccup in stock prices.

But there exists a huge difference between the Fed's tapering of QE and potentially that of the ECB and BOJ.

When then Chairman Bernanke started to wind down QE, the U.S. Ten-Year Treasury was yielding around 3%. And, according to the BLS, the year-over-year rate of inflation was 1.5%.

Therefore, real interest rates were already positive and the nominal rate was above the universally-adopted central bank inflation target of 2%. Hence, the tapering of asset purchases did not cause yields to spike; and that quiescence of borrowing costs kept the stock bubble expanding.

Another reason for the temperance in Treasury yields was the commencement of QE programs from those very same countries. The BOJ and ECB started to print money right around the time of the Fed's termination of asset purchases. BOJ Head Haruhiko Kuroda began Japan's massive bond buying spree in April of 2013. Kuroda pledged to buy at least $1.4 trillion in assets back then and is still going strong with an additional 80 trillion yen each year.

In addition, the ECB President, Mario Draghi, announced he would do "whatever it takes" to drive down yields in the Eurozone in July of 2012; then followed up with an official announcement of QE in January of 2015. Draghi's money printing continues to this day and will amount to a minimum of $2.4 trillion worth by the end of this year.

It is important to note that although the ECB announced a quasi-tapering of assets from 80 billion, to 60 billion Euros per month beginning in March of 2016, it was not a genuine tapering in the least. Not only did Mr. Draghi extend the duration of his bond purchases by another three months, he also stated at his press conference that quantitative easing is open-ended and could extend well past the proposed end date of December 2017. Yet, despite this half-hearted and minuscule step towards tapering, the ECB still caused a doubling of German 10 Year Bund yields in the past month.

Most importantly, the major difference between the Fed's taper and the inevitable turn from the BOJ and ECB is the level of their respective real interest rates.

Japan's 10-Year Note offers a nominal yield of just about zero percent. However, as mentioned already, the BOJ has an inflation target of 2%. If Mr. Kuroda ever has the temerity to end his bond-buying scheme, borrowing costs in this bankrupt nation, which has a total debt to GDP ratio of around 600%, would have to abruptly surge over 200 basis points just to keep even with the central bank's inflation target. Alternatively, rates could surge given the fact that insolvent Japanese Government Bonds will be losing the only buyer willing to receive a guaranteed yield of zero percent.

This difference in real yields is particularly striking in Germany. An inflation rate of 2% isn't just a target...it's a reality. The 10-Year Bund currently yields 0.43%, and the February year-over-year rate of Consumer Price Inflation (CPI) is 2.2%. Therefore, real interest rates are currently a negative 1.77%. If the ECB were to seriously commit to ending its QE program, fixed income investors and speculators would panic to get ahead of the removal of Draghi's bids; and Bund yields could surge well above the rate of inflation in a very short period of time.

Therefore, it is a very credible assumption that the free market will rush to front run the offers from Draghi and Kuroda, and cause chaos in global bond markets.

But if Draghi were to actually taper it would leave only Japan and the much smaller Bank of England left in the money printing business. When Bernanke began tapering the ECB and BOJ picked up the slack and kept global borrowing costs in check. The ECB and BOJ won't be so fortunate.

The bottom line is whenever the ECB or BOJ decide it's time to turn off the air compressor that has been inflating asset bubbles extent within these economies, the likely outcome will be incredibly ugly. A smooth dismount from years' worth of unprecedented interest rate manipulation is impossible due to the historic distortion of asset prices and record debt levels caused by these officially-sanctioned counterfeiters.

If sovereign bond yields do not spike upon the mere utterance of the word taper from the BOJ or ECB, it will be due to investors' perception that deflation and depression are about to spread across the developed world. Why else would bond yields remain anywhere close to 0%? This is especially true give that investors also have to fear the potential outright selling of the gigantic hoard of sovereign debt held by these central banks.

In either scenario, (an inverted yield curve or surging long-term rates) the odds are high that the ending of this historic central bank interest rate manipulation will be the catalyst for currency, equity, fixed income and economic chaos to pervade across the globe. Intelligent investors understand that trillions of dollars' worth of negative yielding sovereign debt will not react well to an interest rate normalization campaign. But I'm sure the perma-bulls will keep on laughing...until it is too late

______________________________________________________________________.

THE TEMPTATIONS OF A RESILIENT CHINA

BY: STEPHEN S. ROACH

NEW HAVEN – Another growth scare has come and gone for the Chinese economy. This, of course, is very much at odds with Western conventional wisdom, which has long expected a hard landing in China. Once again, the Western perspective missed the Chinese context – a resilient system that places a high premium on stability.

Premier Li Keqiang said it all in his final comments at the recent China Development Forum. I have attended this gathering for 17 consecutive years and have learned to read between the lines of premier-speak. Most of the time, senior Chinese leaders stay on message with rather boring statements about accomplishments, targets, and reforms, toeing the official line of the annual “Work Report” on the economy that is delivered to the National People’s Congress two weeks earlier.

This year was different. Initially, Li seemed subdued in his ponderous responses to questions from an audience of global luminaries that focused on weighty issues such as trade frictions, globalization, digitization, and automation. But he came alive in his closing remarks – offering an unprompted declaration about the Chinese economy’s underlying strength: “There will be no hard landing,” he exclaimed.

The all-clear sign from Li was in sync with official data in the first two months of 2017: solid strength in retail sales, industrial output, electricity consumption, steel production, fixed investment, and service sector activity (the latter signaled by a new monthly indicator developed by China’s National Bureau of Statistics). Meanwhile, foreign-exchange reserves rebounded in February for the first time in eight months, pointing to an easing of capital outflows.

At the same time, the People’s Bank of China took its cue from the US Federal Reserve’s rate hike this month, boosting Chinese policy rates by about ten basis points. The PBOC would not have taken that step had it been overly concerned about the underlying state of the Chinese economy.

But the icing on the cake came from the trade data – namely, annual export growth of 4% in January and February, following a 5.2% contraction in the fourth quarter of 2016. This underscores a key contrast between the latest and previous Chinese growth scares.

Call it the Trump effect: the revival of the global economy’s “animal spirits” in recent months has provided important relief for a Chinese economy that is still heavily dependent on exports.

Whereas earlier growth scares were exacerbated by chronic downward pressures from sputtering post-crisis global demand, this time external headwinds have given way to tailwinds.

But while the near-term prognosis for the Chinese economy is far more encouraging than most had expected, an eerie sense of denial, bordering on hubris, appears to be creeping into China’s strategic groupthink. With the United States looking inward, Chinese decision-makers seem to be pondering the opportunity that might arise from a seismic shift in global leadership.

I was repeatedly asked about the possibility of a China-centric globalization – reinforced by Chinese leadership in multilateral trade (the 16-nation Regional Comprehensive Economic Partnership, or RCEP), pan-regional investment (China’s One Belt, One Road initiative), and a new institutional architecture (the Chinese-dominated Asian Infrastructure Investment Bank and the New Development Bank). It’s as if China had been preparing to fill the void being left by Donald Trump’s “America first” US.

The Chinese are keen students of history. They know that shifts in global leadership and economic power are glacial, not abrupt. Yet I get the sense that they view the current circumstances in a very different light: Trump, the great disruptor, has changed the rules of engagement for what had long been a US-centric globalization. Many in China are now wondering whether this may be an opportunity to seize the reins of global power.

Anything is possible – especially in a world where uncertainty is the only certainty. But there is another lesson of history that the Chinese must bear in mind. As Yale historian Paul Kennedy has long maintained, the rise and fall of great powers invariably occurs under conditions of “geostrategic overreach” – when a state’s global power projection is undermined by weakness in its domestic economic fundamentals. Global leadership starts with strength at home, and China still faces a long road of rebalancing and restructuring before it reaches the Promised Land of what its leadership calls the “new normal.”

But here there is another important disconnect between the view inside China and perceptions in the West. The view from outside is that Chinese reforms, the means to rebalancing, have stalled over the past five years under President Xi Jinping. The same view prevailed under the prior ten-year leadership of Hu Jintao. But is this really the correct way to assess what is happening in China?

Results matter more than grand pronouncements. Since 2007, when former Chinese Premier Wen Jiabao laid down the rebalancing gauntlet for a Chinese economy that had become “unstable, unbalanced, uncoordinated, and unsustainable,” China’s economic structure has, in fact, undergone a dramatic transformation. The GDP share of the so-called secondary sector (manufacturing and construction) fell from 47% in 2007 to 40% in 2016, whereas the share of the tertiary sector (services) increased from 43% to nearly 52%. Structural shifts of this magnitude are a big deal. The key point missed by reform deniers is that China is actually making rapid progress on the road to rebalancing.

All of which brings us back to the questions raised at this year’s China Development Forum.

The combination of near-term resilience and an inward-looking US appears to offer a tantalizing opportunity for China. But China should resist the temptations of global power projection and stay focused on executing its domestic strategy. The challenge now is to realize the “tremendous opportunity” that Li touted in ruling out a hard landing.

_____________________________________________________________________________

GETTING TECHNICAL

THE MARKET APOCALYPSE HAS BEEN POSTPONED

Is this the early stage of a real correction – or just a bout of doubt following Trump’s first defeat?

BY MICHAEL KAHN

Getty Images

The market’s euphoria over the election of Donald Trump finally succumbed to the inevitable pullback. The question is whether this the early stage of a real correction – or just a bout of doubt following the president’s first legislative defeat.

There are arguments to be made for both cases. The weight of technical evidence we have so far doesn’t lean heavily either way, and that suggests the market has entered a period of uncertainty somewhere between the two.

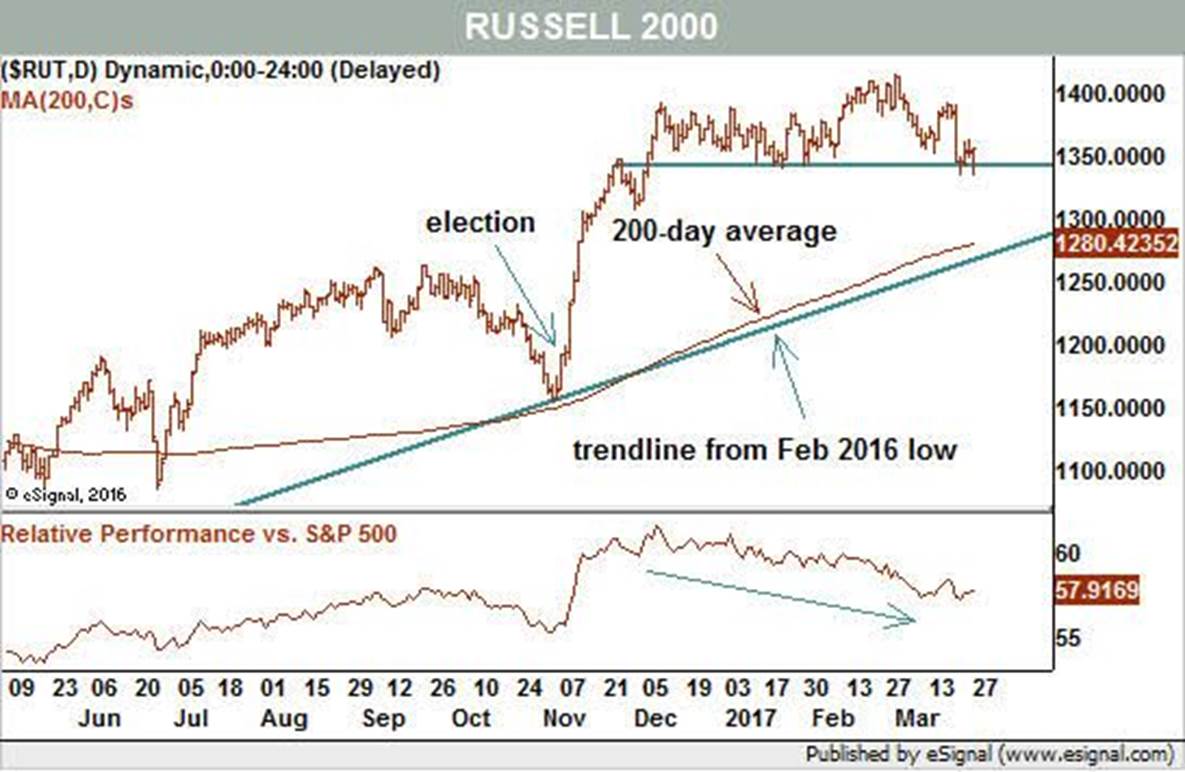

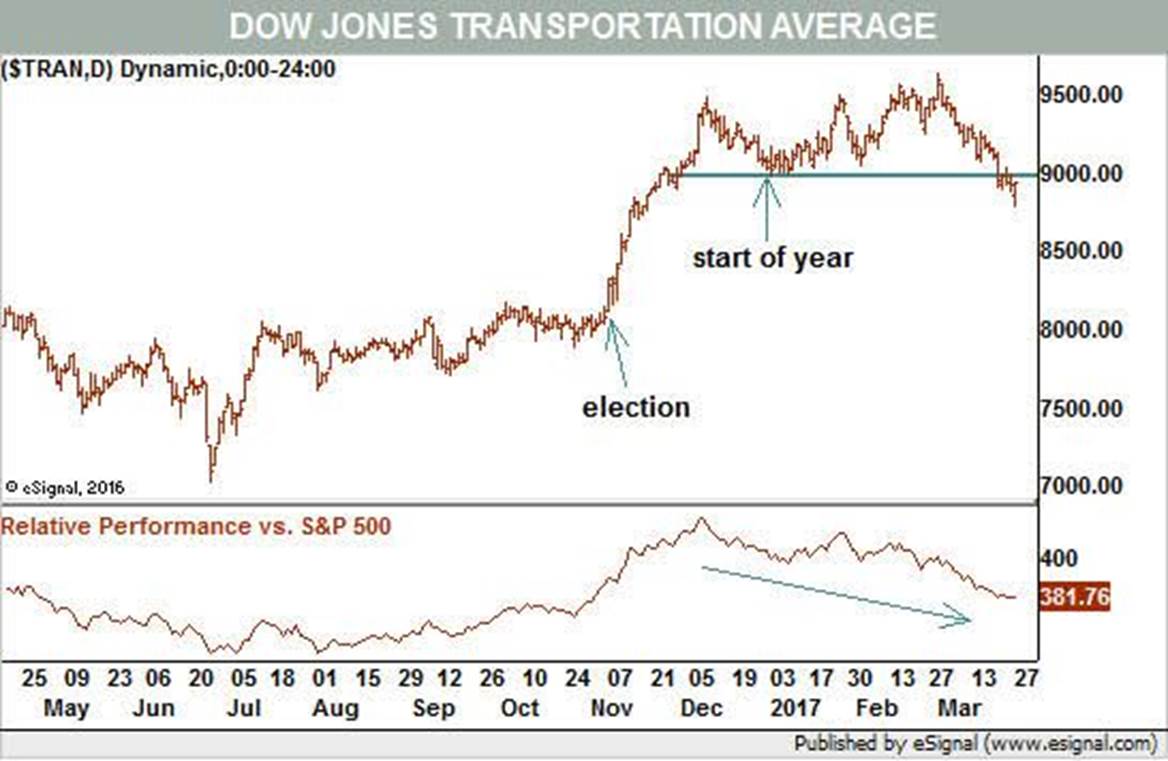

First, the bad news. Two of the market’s key sectors – small stocks and transports – were conspicuously absent from the gains seen between December and February. That was a strong period for the main stock indexes such as the Standard & Poor’s 500 and the NasdaqNDAQ in Your Value Your Change Short position Composite. Yet both the small-cap Russell 2000 and the Dow Jones Transportation Average were flat (see Chart 1).

Dow Jones Transportation Average

And year to date, the S&P 500 is up over 4%, despite a weak March, while the Russell and the transports are slightly in the red.

The negative divergence between these two and the rest of the market is a warning sign. Small stocks tend to lead early in a rally, as they did in November, but lag late. Transports are economically sensitive, and can be canaries in the coal mine when the market starts thinking the economy is not going to grow as expected.

It is true that the broad market is on a losing streak. And it is true that it began March 2, the day after forming an “exhaustion gap” on the charts. This pattern results when overnight demand is so great that the market must jump higher at the open to restore equilibrium. However, because it’s the result of buying by the last bulls, it means all of the market’s fuel is used up – exhausted.

Bulls counter this argument with the pattern on the Russell 2000 itself (see Chart 2).